Third to record the cash payment on the credit purchase of supplies. Debit Account PayableJones Supply Company and credit Supplies D.

Chapter Journal Review Ppt Download

Accounts Payable Supply Company 20000.

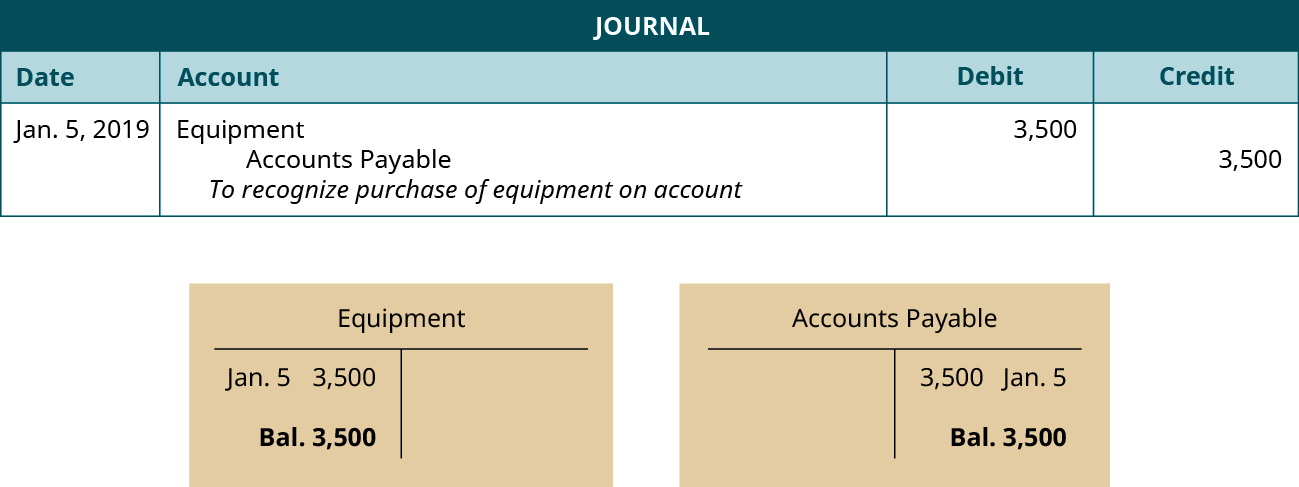

. Accounting for assets like equipment is relatively easy when you first buy the item. For example if a business purchases supplies of pens and stationery for 400 the journal entry to record this is as follows. They include the computer vehicle machinery and so on.

For example suppose a business purchases supplies such as paper towels cleaning products and other consumables for a total amount of 50 and pays for the items with cash. When its time to buy new equipment know how to account for it in your books with a purchase of equipment journal entry. Journal entries are also helpful in organizing accounts payable accounts receivable and expenses in connection with inventory.

Prepare a journal entry to record this transaction. This entry is made as follows. Computers cars and copy machines are just some of the must-have company assets you use.

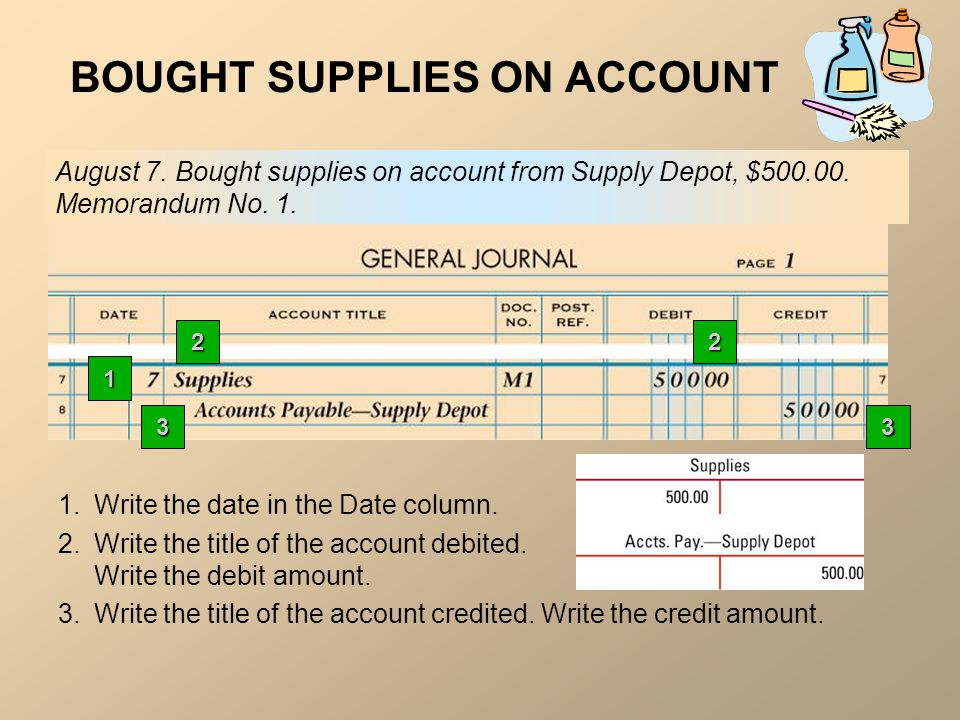

In accounting the company usually records the office supplies bought in as the asset as they are not being used yet. As you are buying on credit you have not paid anything yet and will pay in future which means your liability increases so as per the modern accounting approach we credit when there is an increase in liability. When you clear it pay the supplier then the entry will be.

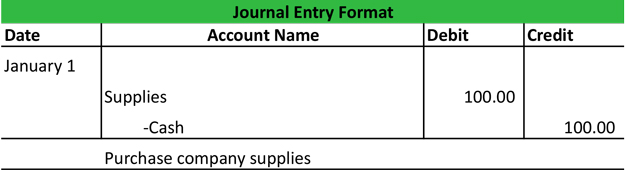

The journal entry is given below. Debit Supplies and credit Cash. Enter the full amount in question.

Thus consuming supplies converts the supplies asset into an expense. Purchased Equipment on Account Journal Entry. Likewise the office supplies used journal entry is usually made at the period end adjusting entry.

For example on March 18 2021 the company ABC purchases 1000 of office supplies by paying with cash immediately. The purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry. When supplies are purchased they are recorded in the supplies on hand account.

The entry to adjust the balance of the supplies account would. Supplies on hand journal entry. A journal entry is when you make a record of a transaction that happens in connection with your personal or business accounts.

Purchasing new equipment can be a major decision for a company. Purchase Of Office Supplies Journal Entry. Basics of Journal Entries Accounting Journal Entry Examples.

They are not for resale. The company purchased supplies which are assets to the business until used. Only later did the company record them as expenses when they are used.

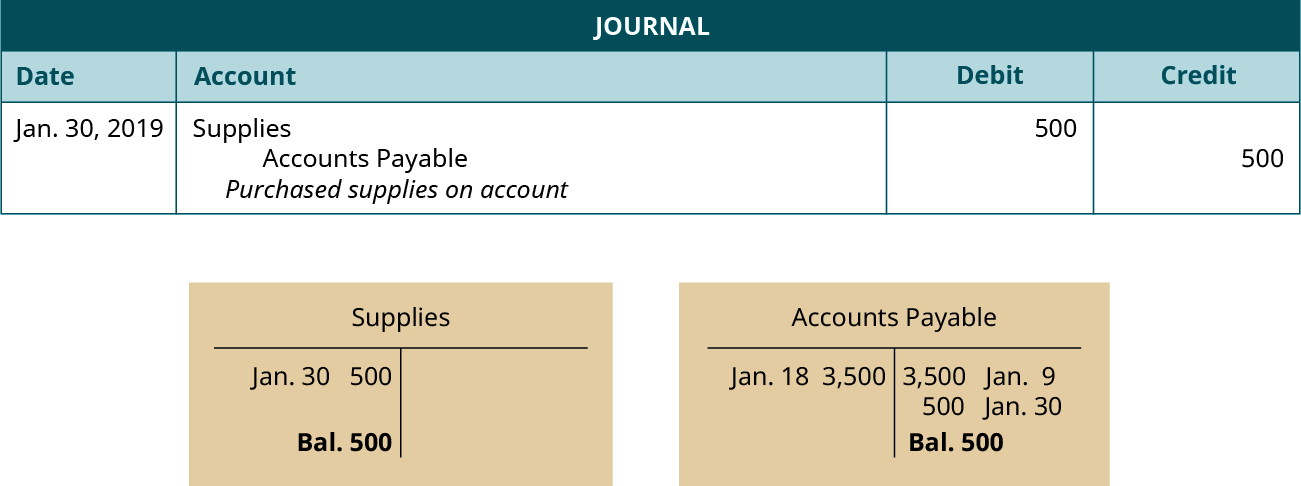

Increase in Assets Merchandise by 6000. Paid Cash for Supplies Journal Entry Example. On January 30 2019 purchases supplies on account for 500 payment due within three months.

Second to record the return of supplies. Equipment is the assets that company purchase for internal use with the purpose to support business activities. A company has 350 in its supplies account at the beginning of the year.

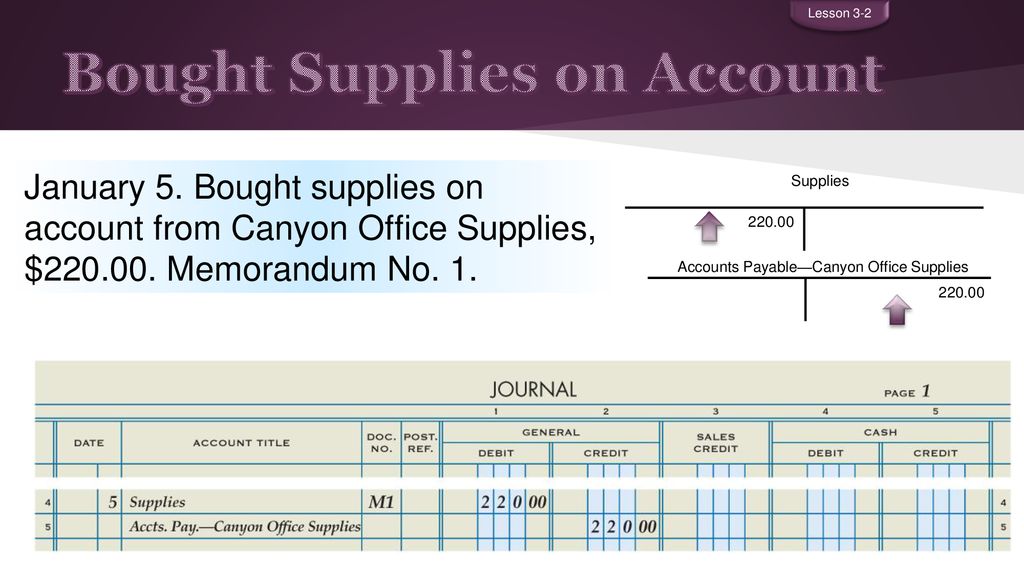

Supplies is an asset that is increasing on the debit side. What is the correct journal entry for the transaction BOUGHT SUPPLIES ON ACCOUNT FROM JONES SUPPLY COMPANY 250. Company ABC purchased Office supplies costing 2500 and paid in cash.

You can use this to keep track of money spent and money received. The company purchased 6000 merchandise 600 units on credit. Debit Supplies and credit Accounts PayableJones Supply Company C.

Also charging supplies to expense allows for the avoidance of the fees. Accounts Payable Supply Company 185000. The journal entry will be.

Q1 The entity purchased new equipment and paid 150000 in cash. The year-end count of office supplies revealed a remaining balance of 400. Office supplies used journal entry Overview.

Despite the temptation to record supplies as an asset it is generally much easier to record supplies as an expense as soon as they are purchased in order to avoid tracking the amount and cost of supplies on hand. 05-12-2017 Close the account after moving the entry to the correct permanent account. When supplies are purchased they are recorded by debiting supplies and crediting cash.

Accounts Payable Supply Company 165000. For suspense account journal entries open a suspense account in your general ledger. More Examples of Journal Entries Accounting Equation Double Entry Recording of Accounting Transactions Debit Accounts.

Debit or Credit. Adjusting Entry at the End of Accounting Period. Journal Entry DebitCredit Equipment 150000 n.

Supplies is increasing because the company has more supplies than it did before. Also enter the same amount with an opposite entry in another. Throughout the year the company purchased an additional 500 worth of supplies which it recorded to the supplies account.

The format of suspense account entries will be either a credit or debit. In this case the company ABC can make the journal entry for the paid cash for supplies on March 18 2021 as below. At the end of the accounting period the cost of the supplies used during the period is computed and an adjusting entry is made to record the supplies expense.

First to record the purchase of supplies on credit. Debit Accounts PayableJones Supply Company and credit Cash B.

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Purchase Office Supplies On Account Double Entry Bookkeeping

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Unit 5 The General Journal Journalizing The Recording Process Ppt Download

Recording Purchase Of Office Supplies On Account Journal Entry

Paid Cash For Supplies Double Entry Bookkeeping

Business Events Transaction Journal Entry Format My Accounting Course

0 comments

Post a Comment